4 Techniques for Improving Your Credit Score Quickly

There are hacks for everything in life, including improving your credit score. If you are struggling to find the financing you need to purchase a home, car or other expensive item because of your low credit score, there is hope! At Coast Tradelines, we have the hacks you need to improve your credit score fast. […]

A Complete Guide To Collections Accounts

If you are like most people, you’ve had a bill or two go unpaid. Maybe you suffered a job loss and couldn’t make your monthly credit card payments. Perhaps a utility bill went unnoticed when you had a lot going on or it got lost in the mail when you moved. Regardless of why the […]

Using AU Tradelines to Boost Your Credit Score

If you’ve been trying to purchase a home or a new car, you may have hit a few speed bumps with your credit score. Your lender may be unwilling to loan you the money needed because your credit score is a bit too low. That low credit score is an indication that you’re at high […]

What You Need To Know About Collection Accounts and Your Credit Score

If you miss payments on an account in your name, the creditor might report the delinquency after a few months. After some time of that delinquency going unpaid, the creditor might begin collections actions or sell the debt to a company that specializes in this area. Not only are collections efforts an uncomfortable disruption to […]

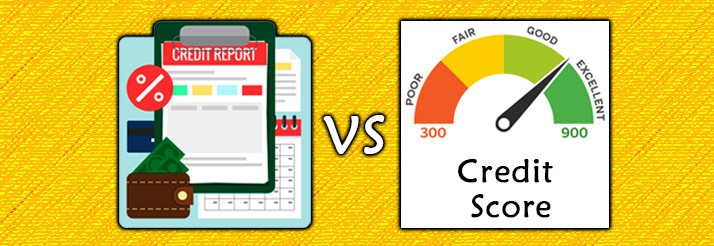

What’s the Difference Between Credit Scores and Credit Reports?

If you are new to the world of credit or to actively building a positive credit history, you might have lots of questions. One of the most common is the difference between a credit report and a credit score. Credit scores provide a quick snapshot of your credit history in the form of one, three-digit […]

Common Credit Score Errors and How You Can Repair Them

There are a lot of consumers with unknown errors on their credit reports. About 25% of people with credit have an error they don’t know about. They’re typically found when someone is trying to obtain a new credit card, purchase a home or obtain a car loan. In those time-crunched situations, it can get frustrating […]